reverse tax calculator australia

70 11 6364 cost before GST. Reverse charge is required on some offshore purchases even though you are the purchaser and even if the sale would not normally be subject to GST.

Gst Calculator Australia Atotaxrates Info

Lodging a tax return.

. Individuals on incomes below 18200 are also entitled to the Low and Middle Income Tax Offset LMITO. The reverse sales tax calculator exactly as you see it above is 100 free for you to use. However its Input tax credit can be availed immediately.

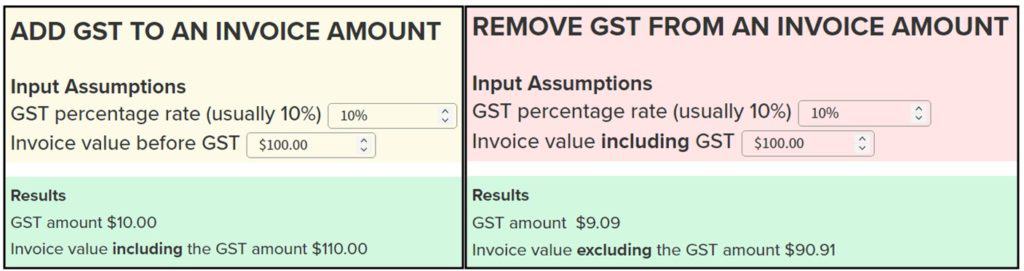

How to calculate reverse GST formula To find the GST from a total divide the total amount by the GST rate divided by 100 and plus 1. When a price inclusive the tax is mentioned in such cases reverse tax is applied. A pay period can be weekly fortnightly or monthly.

Enter net earnings as weekly or annual. The amount of the reverse-charged GST is 10 of the price of the purchase. Here is how the total is calculated before sales tax.

500 is GST exclusive value. Show me tax rates for. To figure out how much GST was included in the price you have to divide the price by 11 2201120.

2675 107 25. Simply enter any one field press the calculate button and all the other fields will be shown. This estimator will help you to work out an estimate of your gross pay and the amount withheld.

Lets calculate this value. Australia Tax Tables available in this calculator. Annual Income Net income Tax paid 0 20000 40000 60000 80000 100000 120000 140000.

Divide the price of the item post-tax by the decimal value. The GST is a broad-based tax of 10 on the supply of most goods services and anything else consumed in Australia. Net Income - Please enter the amount of Take Home Pay you require.

The reverse tax calculator calculate net earnings to gross earnings. You divide a GST inclusive cost by 11 to work out the GST component. Price Before Tax Final Price 1Sales Tax100 Tax Amount Final Price - Price Before Tax.

How to calculate Australian goods and services tax. This easy-to-use calculator can help you figure out instantly how much your gross pay is based on your net pay. Following is the reverse sales tax formula on how to calculate reverse tax.

For each 1 over 120000. 500 is GST exclusive value. Payment of GST under Reverse Charge is made in cash only.

Calculate Australian tax figures fast. Includes 2 medicare levy and low income tax offset. The Australian Taxation Office website.

Tax to gross income ratio 2687. This will give you the items pre-tax cost. This is the NET amount after Tax the actual amount that you get paid after all deductions have been madeIf you select month and enter 3000 we will calculate based upon you taking home 3000 per month.

Current financial year 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009. Subtract the price of. Amount without sales tax QST rate QST amount.

When adding 10 to the price is relatively easy just multiply the amount by 11 reverse GST calculations are quite tricky. Created with Highcharts 309. GST calculator is one of the steps to simply hassle for the taxpayers so in this article let us understand how GST calculator helps us to calculate the GST reverse charge.

500 01 50 GST amount. It can be used for the 201314 to 202021 income years. To get GST inclusive amount multiply GST exclusive value by 11.

In addition to income tax there are additional levies such as Medicare. 2024 Tax Tables 2023 Tax Tables 2022 Tax Tables 2021 Tax Tables 2020. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase.

70 total with GST at 10 GST rate. Just multiple your GST exclusive amount by 01. Simple steps to lodge your 2021 tax return online.

Annual gross income 123061. Up next in Income tax. Tax Year - Select the Tax Year to calculate tax years start 6th April and end 5th April.

To calculate Australian GST at 10 rate is very easy. How to Calculate Reverse Charge under GST. Now you divide the items post-tax price by the decimal value youve just acquired.

This calculator can help when youre making taxable sales only that is a sale that has 10 per cent GST in the price. Sacrificing part of your salary can reduce your tax. You may also choose to pay GST for purchases even though you are the purchaser.

The gross pay estimator will give you an estimate of your gross pay based on your net pay for a particular pay period. Tax bracket start at 0 known as the tax-free rate and increases progressively up to 45 for incomes over 180000. HST reverse sales tax calculation or the Harmonized reverse Sales Tax calculator of 2022 for the entire Canada Ontario British Columbia Nova Scotia Newfoundland and Labrador and many more Canadian provinces.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. 10 100 1 01 1 11. GST Payment and Input Tax Credit Calculator.

Amount without sales tax GST rate GST amount. To work out the cost including GST you multiply the amount exclusive of GST by 11. ICalculators Australian Tax Calculator includes the following tax tables expenses and allowances you can check each year if you wish to query a specific allowance or threshold used if you would like us to add additional historical years please get in touch.

JAWs Oz Tax Calculator for the Current Financial Year. Australian income is levied at progressive tax rates. This financial year started on 1 July 2021.

This calculator in BabaTax Website is used for calculation of setoff of Input tax credit cash and Reverse Charge Mechanism under CGST SGST IGST and Cess. To work out the price without GST you have to divide the amount by 11 22011200. Adding 10 to the price is relatively easy just multiply the amount by 11 reverse GST calculations are quite tricky.

Show tax rate table. Here are the Australian income tax rates and brackets for the 202122 financial year for Australian residents according to the Australian Taxation Office ATO. Annual tax payable 33061.

For each 1 over 180000. Select the frequency weekly or annual 3. How to calculate GST in Australia.

The calculator takes into account Medicare Levy and the Low Income Tax Rebate but does not take into account other rebates such as the Family Tax Benefits Social Security Rebates.

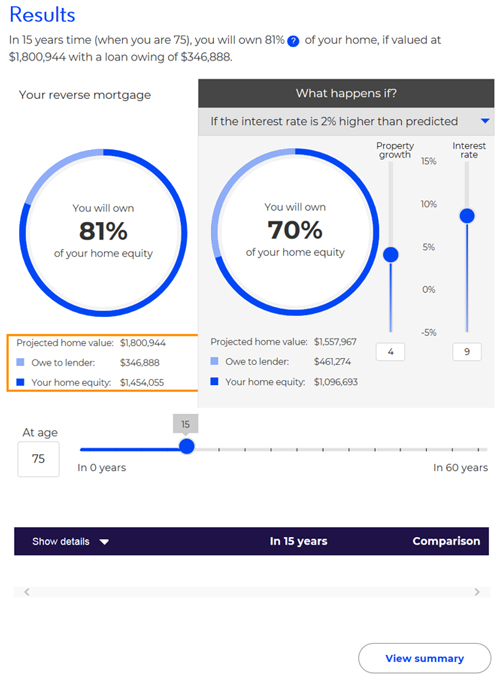

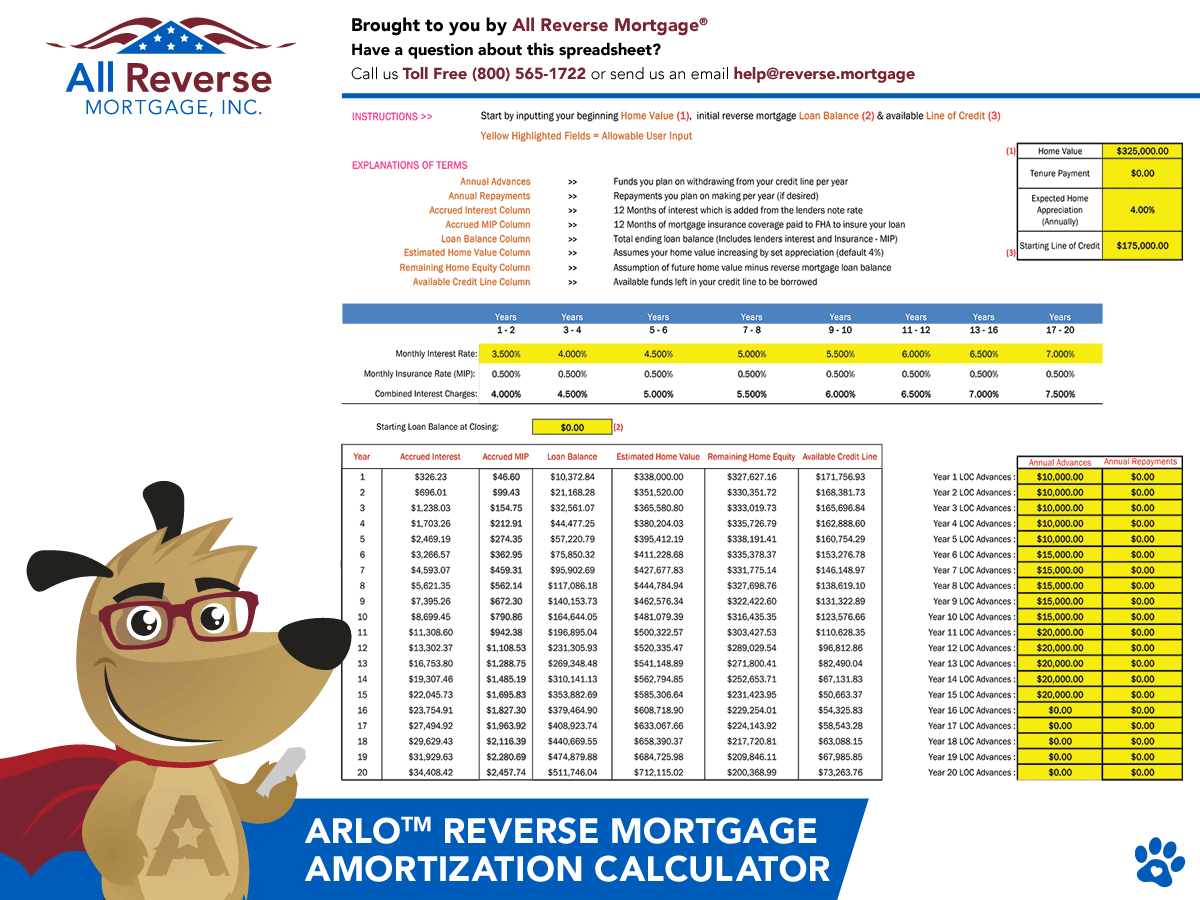

Free Reverse Mortgage Calculator Reverse Mortgage Mortgage Amortization Calculator Mortgage Loan Calculator

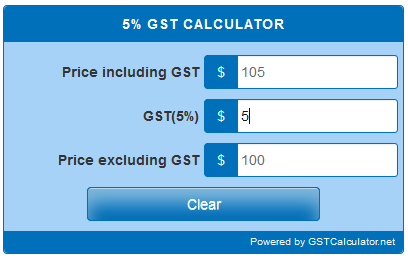

5 Percent Gst Calculator Gstcalculator Net

Mortgage Calculator App Google Search Mortgage Loans Mortgage Loan Calculator Reverse Mortgage

Most Common Types Of Mortgage Loans Sh Loans Mortgage Homeowner Homebuyer Mortgage Loans Loan Mortgage Loan Originator

Accounting Chart Shows Balancing The Books And Accountant Stock Illustration Stock Illustration Royalty Free Illustrations Accounting Accounting Books Photo

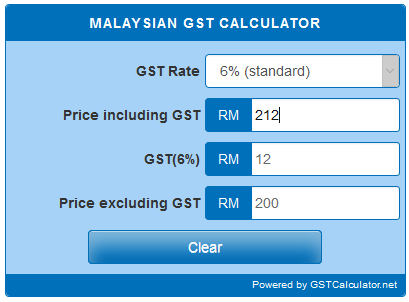

Malaysian Gst Calculator Gstcalculator Net

Reverse Tax Calculator Net To Gross

Commercial Property Lease Or Buy Analysis Calculator Investment Analysis Commercial Property Analysis

Excel Formula For Reverse Tax Calculation Excel Formula Reverse Excel

Contractor Payroll Salary Packaging Novated Leasing Contractor Payroll Services Http Kentucky Nef2 Com Contracto Payroll Managing Your Money Contractors

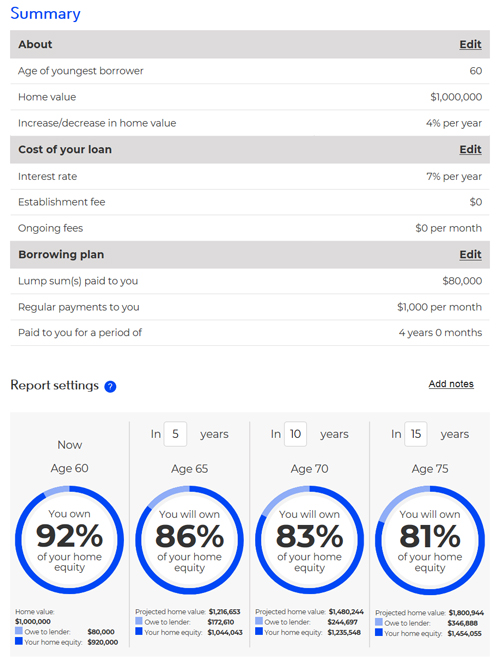

Using Asic S Reverse Mortgage Calculator Asic Australian Securities And Investments Commission

6 Percent Gst Calculator Gstcalculator Net

Free Reverse Mortgage Amortization Calculator Excel File

![]()

Free Income Tax Calculators Australia Ashburn Tax Accountants

A Good Mortgage Broker Can Save You Time Money But An Inexperienced Mortgage Broker May Waste Your Much Prec Mortgage Brokers Mortgage Lenders Mortgage Blogs

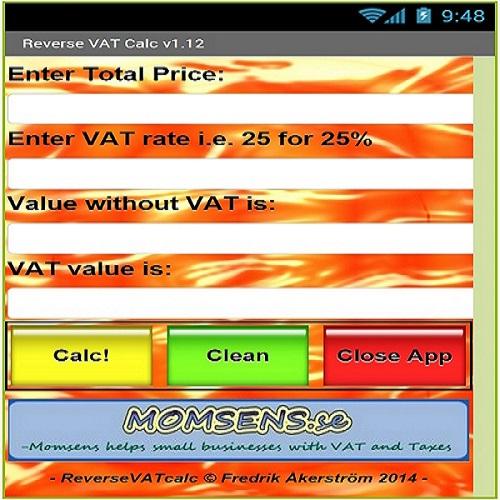

Backward Vat Calculator Accounting Finance Blog

Reverse Tax Calculator Net To Gross

Using Asic S Reverse Mortgage Calculator Asic Australian Securities And Investments Commission