putnam county property tax rate

The median property tax on a 12400000 house is 79360 in Putnam County. Below is more detailed information regarding taxes.

Putnam County Ny Property Tax Search And Records Propertyshark

In New York State the real property tax is a tax based on the value of real property.

. The order also gives the total tax rate for each taxing district. Putnam County Sheriffs Tax Office 236 Courthouse Drive Suite 8 Winfield WV 25213 304 586-0204. Developed by WTH this innovative technology provides revolutionary capabilities including pin-point mapping synchronized data sharing and instant software updates together with industry-leading customer support.

Ad Find Putnam County Online Property Taxes Info From 2021. February 15 2022 You may begin by choosing a search method below. PUTNAM COUNTY TAX DIVISION.

Search Putnam County Records Online - Results In Minutes. The median property tax on a 12400000 house is 84320 in Tennessee. If there is more than one suffix ie.

What is the Putnam County tax rate. Benroth who was elected County Auditor in November 2006. The money funds schools pays for police and fire protection.

The Putnam County Commission sets the tax rate it is usually set in July. You can also get additional insights on median home values income levels and homeownership rates in your area. Treasurer Warnecke is the 33 rd Treasurer.

Avenue Street Street Court etc you must spell out the name of the 1st suffix and abbreviate the 2nd suffix in the property address field. Residents may contact the Tax Division at 304 586-0204 with tax questions. Putnam County Stats for Property Taxes.

Who sets the county tax rate and when. With our guide you will learn important facts about Putnam County property taxes and get a better understanding of things to plan for when it is time to pay the bill. Our office only collects county taxes and does NOT collect city taxes.

Changes occur daily to the content. If you are presently living here just pondering taking up residence in Putnam County or planning on investing in its real estate investigate how district real estate taxes work. When mailing tax payments please mail to.

2022 Putnam County Budget Order - Issued January 5 2022. Counties cities towns villages school districts and special districts each raise money through the real property tax. Does the Putnam County Trustees Office collect city taxes.

Niese Warnecke was appointed Putnam County Treasurer in March 2007 to fulfill the unexpired term of Treasurer Robert L. The Honorable Tracy L. The 2021 county tax rate is 2472 10000 2472 assessed value.

Treasurers Office Putnam County Indiana Previous Next Property Tax Information Think GIS is one of the worlds most accessible GIS software solutions. The assessment value divided by 10000 and multiplied by the tax rate will give you the amount that should appear on your tax notice from the Putnam County Trustees Office. We Provide Homeowner Data Including Property Tax Liens Deeds More.

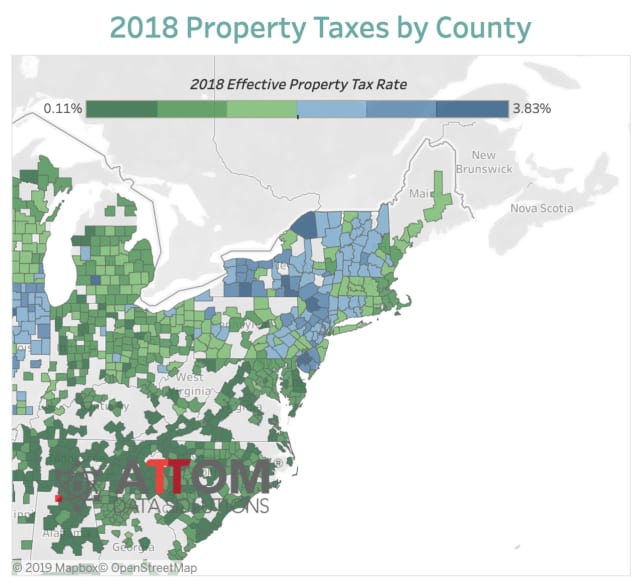

For an easier overview of the difference in tax rates between counties explore the charts below. Taxpayers will be given thirty 30 days from the date the demand is made to make paymentIf these amounts go unpaid state law requires the County Treasurer to apply for judgment with. Assessment value is a percentage of the market value.

Ad Uncover Available Property Tax Data By Searching Any Address. 2020 Putnam County Budget Order - Issued December 20 2019. Exemptions applications for Real Property should be filed with the Property Appraisers Office.

2 discount applies to current real property and tangible personal property tax payments postmarked on or before January 31st. Property tax information last updated. To obtain the most current information please contact the Putnam County Tax Collectors office.

Business owners need to file their Tangible Personal Property Return form DR-405 with the Property Appraisers Office. View an Example Taxcard. Prior to her appointment Warnecke worked 9 years for the Village of Ottawa.

Personal Property Tax Judgments In July of each year taxpayers will be sent a demand notice by certified mail for payment of delinquent personal property taxes penalties and collection fee. The accuracy of the information provided on this website is not guaranteed for legal purposes. Taxes paid after the month of April must be paid with guaranteed funds.

Putnam County property owners have the option to pay their taxes quarterly. Putnam County Property Taxes become delinquent April 1 of the year of assessment at which time a 3 penalty is added to the real estate tax bill. In Florida Property Appraisers are independent constitutional officers duly elected from their counties of residence by their fellow citizens and taxpayers.

1234 5th Street Ct E. Records Management Liaison Officer. 2021 Putnam County Budget Order - Issued January 8 2021.

Putnam County Property Appraiser. Installment payments are made in June September December and March. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Putnam County Tax Appraisers office.

Also please make your check out to Putnam County Sheriff Robert Eggleton. 2021 Putnam County Budget Order AMENDED - Issued February 12 2021. The median property tax also known as real estate tax in Putnam County is 733100 per year based on a median home value of 41810000 and a median effective property tax rate of 175 of property value.

25 residentialfarm 30 business personal property and 40 commercial. If Putnam County property tax rates are too high for your wallet resulting in delinquent property tax payments a possible solution is getting a quick property tax loan from lenders in Putnam County OH to save your property from a looming foreclosure. 236 Courthouse Drive Suite 8 Winfield WV 25213.

SEE Detailed property tax report for 21 Brookdale Rd Putnam County NY. 3207 33rd ST 5310 3rd ST CT W. Instead contact this office by phone or in writing.

All online payment transactions are final and cannot be reversed. Customers wishing to pay their taxes by installment must fill out APPLICATION and submit it to the tax collectors office by April 30 th of the year they wish to begin making installment payments.

April S Marketwatch Is In Look At That Interest Rate Indiana Marketing Things To Sell

These Hudson Valley Counties Have Highest Property Tax Rates In Nation New Study Says Ramapo Daily Voice

Where Do Tn Residents Receive Most Value For Property Taxes Sparta Live

Property Tax By County Property Tax Calculator Rethority

North Central Illinois Economic Development Corporation Property Taxes

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Property Tax By County Property Tax Calculator Rethority